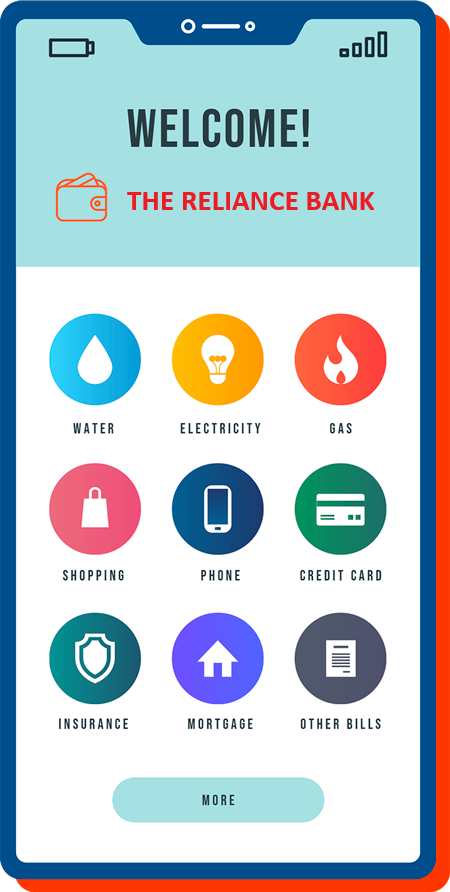

Customer can enjoy the convenience of banking service.

Get it on PC or Mobile to create, send and receive money.

For availing SME loan it is required to mortgage collateral/security.

Reliance Bank offers a wide range of loans to suit your needs.

A place for everyone who wants a simple banking system. Deposit funds using payment gateway or bank transfer. A Bank at fair price is guaranteed. Nothing extra. Join over 700,000 users from all over the world satisfied with our services. A place for everyone who wants simple loans and DPS. Even with a history of hefty technological investments and an even larger donations, consumer and investor confidence has never waned.

The client perspective depends on Business first growth.

Protection against DDoS attacks,

full data encryption

Providing services in 99% countries around all the globe

Popular methods: Visa, MasterCard, bank transfer, cryptocurrency

Trading via our Mobile App, Available in Play Store & App Store

Reasonable trading fees for takers and all market makers

Fast access to high liquidity orderbook for top currency pairs

Follow below steps for a successful transaction

The best price we only can ask for you.

The client perspective depends on Business first growth. How big business can be. We provide best service all area.

Though we have provided lots of information about us and how we serve what is our working process our terms and conditions our policies etc.